Private equity companies increase funds by obtaining resources dedications from external financial institutions. They likewise installed some of the their own resources to contribute right into the fund (generally 1-5% but it can be higher).

The strategies private-equity companies may utilize are as complies with, leveraged buyout being one of the most important. Its current roster of portfolio firms include Flash Networks, Fundbox and Rodenstock. The equity capital market, where financial institutions help business raise equity funding, comprises the main market as well as secondary market. An endeavor capital-backed IPO refers to offering to the public shares in a company that has actually formerly been funded mainly by private financiers. When it took place in 1988, empire RJR Nabisco`s acquisition by Kohlberg, Kravis & Roberts for $25.1 billion was the greatest purchase in private equity background.

In acquistions, the schedule of financial debt funding can have a big impact on the range of private equity task, as well as it seems to impact assessments observed in the market. Early-stage endeavors need very various strategies than leveraged acquistions. Private equity professionals have a tendency to utilize numerous methods when executing an evaluation, as well as they explore various situations for the future advancement of the business.

Private-equity specialization is normally in particular industry sector possession monitoring while hedge fund expertise remains in industry field equity capital monitoring. Finally, private-equity companies only take lengthy positions, for brief marketing is not feasible in this possession class. Meanings of private equity vary, however below we include the entire property course of equity investments that are not estimated on stock markets. When the target is openly traded, the private equity fund executes a public-to-private deal, eliminating the target from the stock exchange. But acquistion transactions generally entail private companies as well as very usually a specific department of an existing firm.

Tyler Tysdal and his passion of entrepreneurship is as strong now as it was throughout that trip to the post office with his mom so many years back. He wishes to “release the business owners” as his personal experience has definitely released him all through his life. When he is not consulting with entrepreneur or speaking to potential business purchasers, Tyler T. Tysdal hangs out with his better half, Natalie, and their 3 children.

Throughout the Great Depression, Congress started thinking of ways to shield the nation from future recessions. Ultimately, Congress passed the Securities Act of 1933 and after that the Securities Exchange Act of 1934. The latter developed the Securities and Exchange Commission in an effort to restore public self-confidence in the economic markets, among other goals. No-action letters are letters by the SEC team suggesting that the personnel will certainly not advise to the Commission that the SEC embark on enforcement action versus a person or firm if that entity takes part in a certain activity. These letters are sent in response to demands made when the legal condition of a task is unclear.

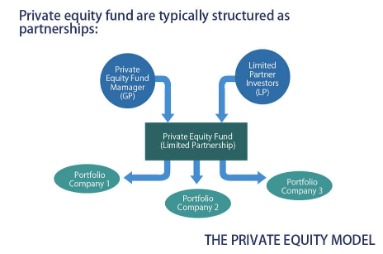

Funds of funds, as the name suggests, invest in other funds, which might have private equity, mutual funds or hedge funds. Brought passion capital gains is the section of investment earnings fund managers contractually get, based upon the contract with the fund investors.

Private equity`s sweet place is acquisitions that have been undermanaged or undervalued, where there`s an one-time possibility to increase a service`s worth. Once that gain has been understood, private equity companies cost an optimum return. A business acquirer, in contrast, will certainly weaken its return by hanging on to business after the development in worth tapers off.